The word “YouTube” appears 108 times in a newly released 89-page study from Cumulus Podcast Network and Signal Hill Insights. It is called Podcast Download — April 2023 Report. Get it HERE.

The word “YouTube” appears 108 times in a newly released 89-page study from Cumulus Podcast Network and Signal Hill Insights. It is called Podcast Download — April 2023 Report. Get it HERE.

In this substantial piece of work, conducted by MARU/Matchbox in April, the focus is on profiling heavy podcast consumers who listen weekly. The survey questions how they listen, their preferred platforms, how video fits in, and their attitudes toward podcast advertising. The result is a rich, multi-faced, detailed portrait of the podcast consumer market.

Key takeaways as stated by the presentation document:

- The longer you have been listening to podcasts, the more podcasts you consume: Average weekly time spent with podcasts and the average number of podcast shows and episodes listened to increases as podcast consumer tenure increases.

- Podcast advertising captures hard-to-reach, ad-free video streamers: Weekly podcast consumers are also heavy viewers of ad-free video streaming services.

- Podcast consumers want more content: Most weekly consumers follow hosts on social media and plan to attend live podcast events. When considering paid subscriptions, they value exclusive content/access ahead of an ad-free experience.

- Advertiser use of podcast ads continues to grow at a breakneck pace: In the Advertiser Perceptions study, advertisers say their use of podcasts has jumped from 15% to 61% in the past seven years, up 16 points in the last year alone.

- Funny and entertaining ads offer a creative opportunity: While podcast consumers remain highly receptive to podcast ads, they prefer funny and entertaining podcast ads in contrast to the more rational podcast ads they currently hear most often.

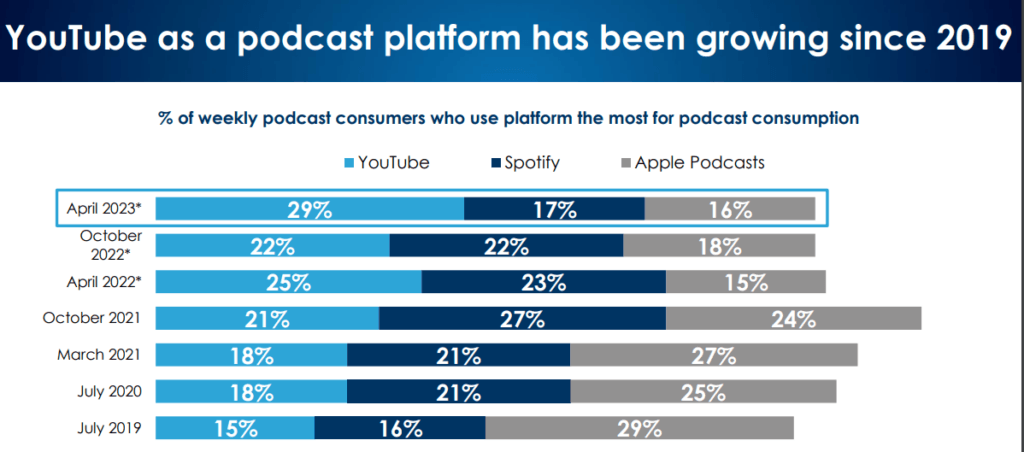

- YouTube is the leading podcast platform: Growing interest in video podcasts has helped to propel YouTube to overtake Spotify as the most used platform by weekly podcast consumers across major demos.

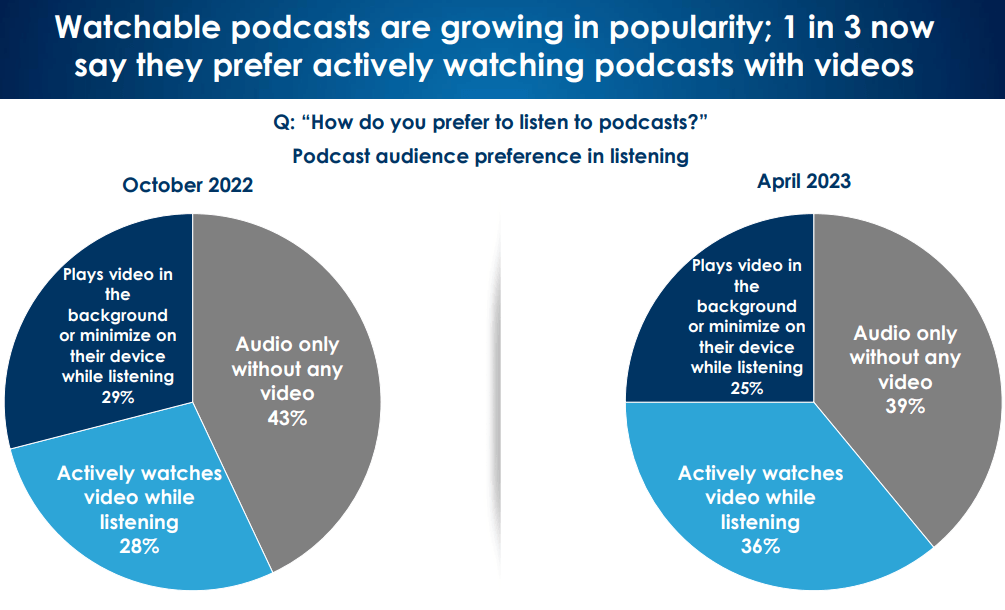

- Watchable podcasts have grown in popularity: Driven by Podcast Newcomers, more consumers prefer podcasts with video they can actively watch or minimize to listen in the background vs. podcasts that are just audio.

- YouTube is a critical entry point for podcast discovery: 34% of weekly podcast consumers who listened to a new podcast in the past 6 months started listening to their latest podcast on YouTube. This is more than both Spotify and Apple Podcasts combined (33%).

- YouTube podcast consumers aren’t tied to the platform: 77% of weekly podcast consumers who have consumed podcasts on YouTube say they would switch platforms from YouTube if a podcast were to become available only on another platform. 54% of YouTube podcast consumers say they already have listened to the same podcasts they consume on YouTube in another place.

All of that is delivered before slide #6. Everything that follows is worth looking at. We note a selection of interesting insights:

Eight percent of podcast consumers “only watch” their shows.

Weekly listeners consume an average of 6.8 hours per week. They skew young (18-34). Thirty percent of them are newbies — started in the last year.

The following chart gives some insight into the growth of YouTube as an important listening platform:

The study devotes several pages to comparing YouTube to Spotify across various listening habits. One outstanding metric: YouTube beats Spotify in discovery, 24% to 15%. When it comes to continued listening of shows discovered on YouTube, more than half of respondents (54%) migrate to other platforms sometimes. The reason is what the study calls “utility” — for example, listening in the car where YouTube might not be as convenient.

On the whole, “watchable” podcasts are growing:

Again, the study is available HERE.