Media intelligence company Magna Global has released the latest edition of its U.S. Advertising Forecast report, measuring ad spend in the first half of 2021, compared to H1 2020. This upward-pointing research shows gains all over the place, with all major industry verticals participating in increased spending.

Across the board, this report shows digital media categories harvesting greater ad-revenue uplift than analog counterparts: “the advertising revenues of traditional media owners (incl. long-form video, audio, publishing, OOH) grew by +11% year-over-year while pure-play digital ad formats (incl. search, social, short-form video, digital audio) expanded by +49%.”

In the audio realm, ad revenue grew +29% across all categories of analog and digital — defined by Magna as “traditional radio broadcasters and pure players, including broadcast radio, audio streaming and podcasting.”

The digital side of audio substantially outperformed the combined types: “Digital audio pure play (streaming and podcasting) grew by +51%.”

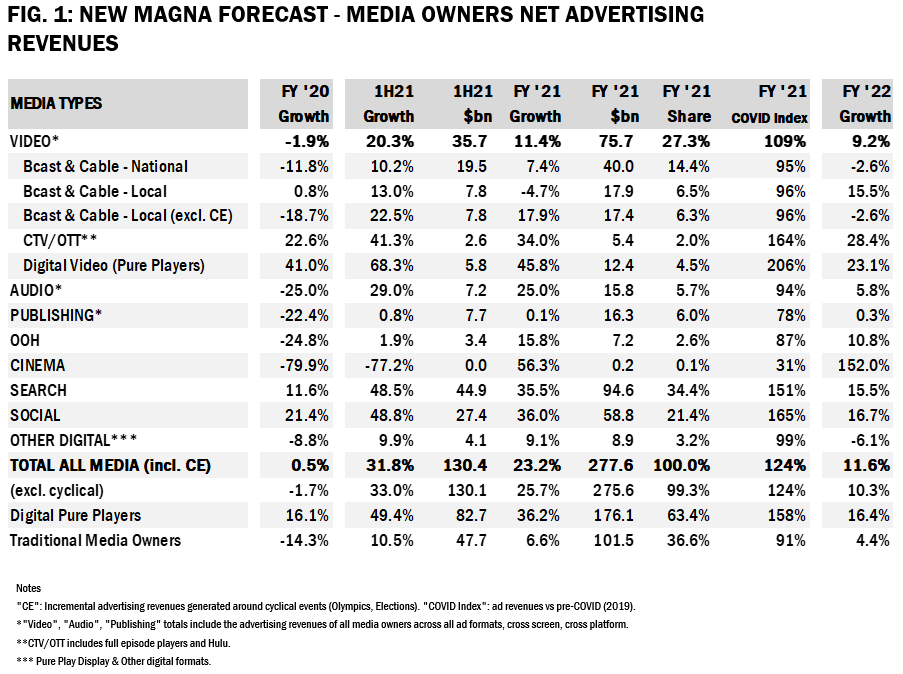

The following table illustrates first-half results in Magna’s forecast; the AUDIO line is comprehensive of audio types; digital audio is not broken out in this graphic.

Magna boldly hypothesized a full year completely recovered from Covid restrictions, and projected ad spending’s return to pre-Covid levels: “In a year that should finally be entirely free of COVID-restrictions, without any remaining supply issues (affecting industries such as auto) or capacity issues (affecting travel, restaurants, theaters and local businesses), economic growth and consumption will remain strong and all industry verticals will finally catch up with pre-COVID levels of ad spend.”

.