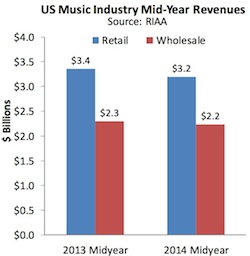

The RIAA released sales and revenue numbers for the first half of 2014. At the top line, a decrease of 4.9% in overall revenue. Income for the first six months of the year totaled $3.2 billion, compared with $3.4 billion in the same period of 2013.

The RIAA released sales and revenue numbers for the first half of 2014. At the top line, a decrease of 4.9% in overall revenue. Income for the first six months of the year totaled $3.2 billion, compared with $3.4 billion in the same period of 2013.

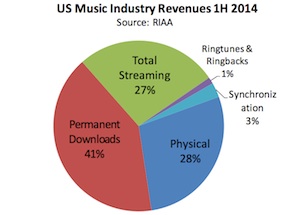

A decline in digital downloads was a major part of the drop in revenue, but the report noted that streaming services did offset that slide. Streaming posted 28% growth during the half-year, from $673 million in H1 2013 to $859 million in H1 2014. These services supplied 27% of total industry revenue during the front half of the year, drawing close to the 28% share represented by physical music sales.

Delving deeper into the streaming and subscription field, the RIAA found a year-over-year increase in each of its three revenue metrics for that industry. SoundExchange distributions rose 21.4% to $323.4 million, paid subscription revenue increased 23.2 percent to $371.4 million, and ad-supported on-demand streaming pulled in 56.5 percent more at $164.7 million.

Delving deeper into the streaming and subscription field, the RIAA found a year-over-year increase in each of its three revenue metrics for that industry. SoundExchange distributions rose 21.4% to $323.4 million, paid subscription revenue increased 23.2 percent to $371.4 million, and ad-supported on-demand streaming pulled in 56.5 percent more at $164.7 million.

(NOTE: The RIAA defines ad-supported on-demand streaming as “Ad-supported audio and video music services not operating under statutory licenses.” That definition separates the ad-supported revenue from SoundExchange revenue, and presumably refers to ad-supported streaming features within on-demand services like Spotify [which uses direct-negotiated licenses], and YouTube.

On the music-sales side, the RIAA numbers show continued declines. Downloaded singles dropped 11% in revenue (9% in unit volume), and downloaded albums skidded 14% in revenue (11% in volume). The CD decline is steeper, unsurprisingly — 19% revenue drop and 24% down in units.

These figures and trends represent a contrast the RIAA’s full-year 2013 report, which had the advantage of holiday sales in the second half as it compared sales and revenue to full-year 2012. In that view, downloaded singles were down slighty, and downloaded albums were up slightly. Streaming demonstrated rampaging double-digit growth in full-year 2013 — so today’s H1 2014 numbers are a continuation of that vigorous trend.