Music Biz and AudienceNet have released their Audio Monitor report on U.S. music consumption habits. The survey examined trends for on-demand streaming, which are being heavily driven by the youngest listeners, as well as AM/FM radio and smart speakers.

Listening to music was tied for the top media outlet among the overall responses at 20%, but younger ages over-indexed on the subject. For ages 16-19, music secured 25%, while it reached 21% for ages 20-24. Rates were also high among ages 45-54, which was also 25%, and ages 55-64 at 22%. When analyzed for time spent, there was a clear trend of preference among younger listeners. The average daily time spent listening to music was 151 minutes. Within the 16-24 group, the rate was 175 minutes, followed by 156 minutes for ages 25-34 and 159 minutes for ages 35-44. All of the older age brackets reported less than the average minutes.

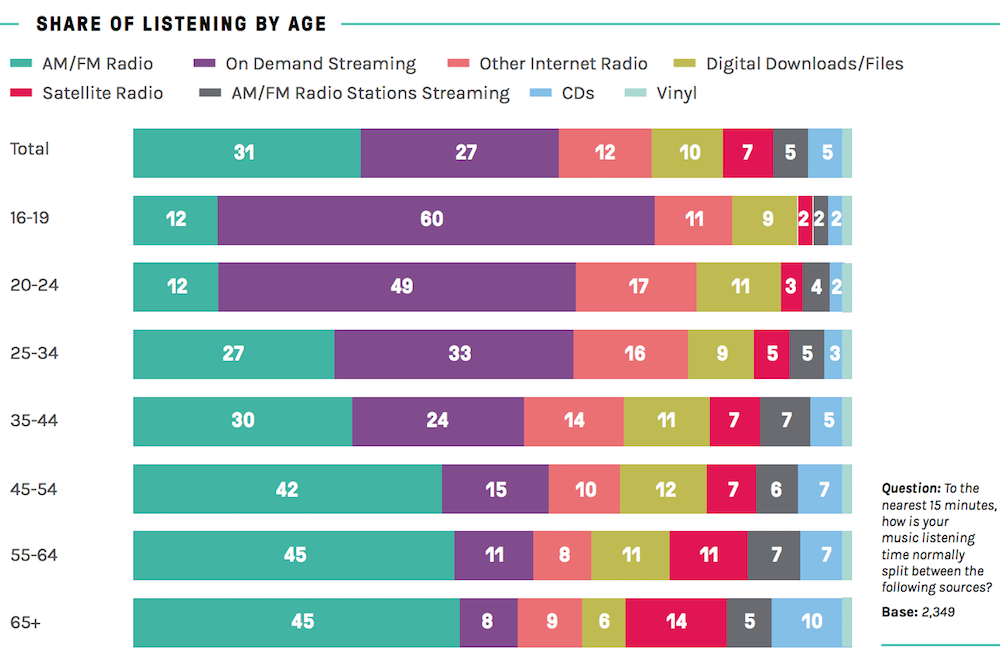

On-demand streaming has grown its share of listeners’ music habits over the years, growing from 24% in 2016 to 27% in 2018. AM/FM radio is still the largest portion at 31%, but that slice is down from 35% in 2016. Other forms of Internet radio, such as Pandora, saw a jump from 10% in 2016 to 12% in 2018, while digital downloads moved in the reverse from 12% to 10%.

On-demand streaming has grown its share of listeners’ music habits over the years, growing from 24% in 2016 to 27% in 2018. AM/FM radio is still the largest portion at 31%, but that slice is down from 35% in 2016. Other forms of Internet radio, such as Pandora, saw a jump from 10% in 2016 to 12% in 2018, while digital downloads moved in the reverse from 12% to 10%.

Terrestrial radio and on-demand streaming also showed the most range in popularity across age groups. Although radio was the top performer overall, it was responsible for only 12% shares in the listening for both the 16-19 and 20-24 age groups. Those brackets were much more likely to spend time streaming, with 60% and 49%, respectively. The habits were flipped for the oldest groups, with a much higher rate of time spent with AM/FM radio and as low as 8% streaming on demand.

YouTube was the top performer for all age groups’ on-demand streaming platform, and took an overall share of 38%. Spotify took a comfortable second place with 28%, and Apple Music trailed with 9%. Amazon Prime Music had an overall share of 7%, but also posted a noteworthy spike to 24% for the over-65 set. YouTube also topped weekly reach at 36% overall. Pandora performed well here with 21%, then Spotify with 17%. CDs had just 13% weekly reach and iHeartRadio had 11%.

While the broad category of radio receivers had the largest share of listening by platform at 36%, mobile phones’ share of 25% was the most listened-to individual device. With that 6% rise over 2017, smartphones and cellphones now command twice the combined listening share of laptops and computers. Usage trends for radio receivers and smartphones echoed those seen for AM/FM and on-demand streaming across age groups. At the farthest extremes, the 16-19 group reported a 7% share for radio receivers and 45% for listening on smartphones, while the 65+ group had 45% spent with radio and just 4% with smartphones.

Finally, the report inquired about smart speaker ownership. Amazon boasted a large lead, with 42% ownership of the Echo Dot and 40% ownership of the Echo. It’s other Echo models took single-digit shares. Google was the clear second place with 12% apiece for its Google Home and Google Home Mini. Listening to music was the top activity for the owners of these devices. Smart speakers have been impacting habits in how owners listen to music (73%), listen to radio (65%), and listen to podcasts (62%). Half of smart speaker owners said they listen to more music since acquiring the device, and 49% said they spend more time doing so following the purchase.

Finally, the report inquired about smart speaker ownership. Amazon boasted a large lead, with 42% ownership of the Echo Dot and 40% ownership of the Echo. It’s other Echo models took single-digit shares. Google was the clear second place with 12% apiece for its Google Home and Google Home Mini. Listening to music was the top activity for the owners of these devices. Smart speakers have been impacting habits in how owners listen to music (73%), listen to radio (65%), and listen to podcasts (62%). Half of smart speaker owners said they listen to more music since acquiring the device, and 49% said they spend more time doing so following the purchase.

The July 2018 survey included a sample of 3,000 participants aged 16 and up selected to be representative of the United States population.