Midia Research released a new data report called State of the Streaming Nation, a comprehensive analysis of the audience and economics of streaming music globally. While available only to Midia Research subscribers, Managing Director Mark Mulligan shared the report with RAIN News.

State of the Streaming Nation positions itself at a pivotal point in the evolution of streaming, marking 2015 as “the year in which streaming music came of age.” While that first sentence sets the stage, the report’s conclusion fleshes out a cautionary reality: “2015 may have been the year that streaming came of age but the bar has now been raised and much more is needed over the coming years.”

An Unbalanced Balance

One key aspect of music streaming is its bifurcation of free listening and music subscriptions. Those two dimensions represent different business models — advertising for free non-interactive listening, and monthly membership for interactive services. As such, the first competes mainly with radio, and the second faces off against the music industry (with the music industry’s sometimes grudging cooperation).

The fact that music streaming is facing in two directions at once is part of the identity crisis which forms a thesis of Midia’s report. An intriguing part of the hybrid industry lies in economics: Subscription music is not as popular as free listening, but it is much more lucrative. That’s a well-known fact generally, and the Midia study puts numbers against it:

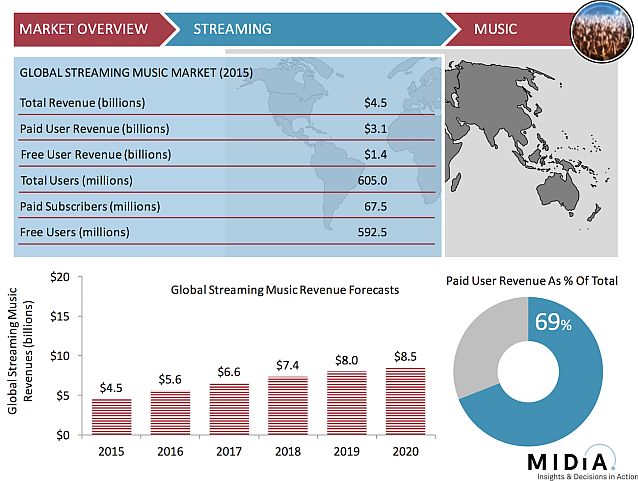

- Total streaming revenue is $4.5-billion. Of that, 69% comes from paid use.

- But on the audience side, only 9% of 605-million total users around the world are paying for music subscriptions.

So, while nearly 70 cents of every dollar comes from monthly membership payments, more than nine out of 10 users ignore music subscriptions and listen to their tunes free.

“YouTube remains the main game in town.” –Mark Mulligan, Midia Research

What Should Music Access Cost?

“Lack of pricing innovation” — that is one key inadequacy that prevents greater adoption of music subscription services, according to State of the Streaming Nation. “Pricing will be a crucial component of creating products that work for those mainstream consumers, at the very least for modest spending download buyers.”

The report emphatically recommends exploring sub-$10 pricing to open a market of casual music buyers for whom $120/year is too great a commitment. At the same time, Midia praises upper-end products such as Tidal’s high-rez streaming at a premium price.

Without that price innovation, Midia’s report tamps down expectation of truly mainstream adoption of streaming: “The indications are that at current rates streaming is not about to accelerate through to mainstream total population adoption. There are many factors behind this, the most impactful of which is the fact that $9.99 is not a mainstream price point.”

Uplift

Still, the report documents a near-doubling of streaming revenue growth between 2015 and 2020, to $8.5-billion. The optimism foresees continued audience migration to cloud-based access of music, and the monumental importance of that trend.

“The consumer behaviour shift from ownership to access, from downloading to streaming is an inevitability, even if the current business models wrapped around it are not. This is the single biggest shift that the music industry has faced since the creation of phonograph and with it the creation of the recorded music business.”

“Streaming is the music industry’s growth story.” –Midia Research

U.S. readers should note that the Midia research is global, and all the more interesting for that. “The streaming market has a far higher degree of geographic diversity than the US dominated download market ever did,” the report notes.

Audience numbers are charted for a diverse range of music services and Internet radio outlets around the world, putting a broader perspective on competitive positioning than U.S. observers tend to think. “Spotify and Pandora” is a popular phrase for succinctly referring to streaming music in the U.S. Midia Research not only (properly) separates those two business models, but inserts impressive audience metrics for several other brands. In the music subscription business, the leading duopoly is really Spotify and Apple Music. And on the free-listening side, Pandora is challenged (or exceeded in the audience-size department) by iHeartRadio, Radionomy, SoundCloud — and YouTube which is analyzed in more details than usual in streaming research papers.