Verto Analytics has released its annual index of streaming music services offering snapshots of performance according to Verto’s proprietary measures. Four brands are examined: Spotify, Pandora, Apple Music, and TuneIn. Verto specializes in cross-device analytics to get a handle on listening behavior across devices, apps, and platforms.

The report puts a focus on measuring listener loyalty with its “stickiness” metric and examines which platforms have had success attracting particular listener demographics.

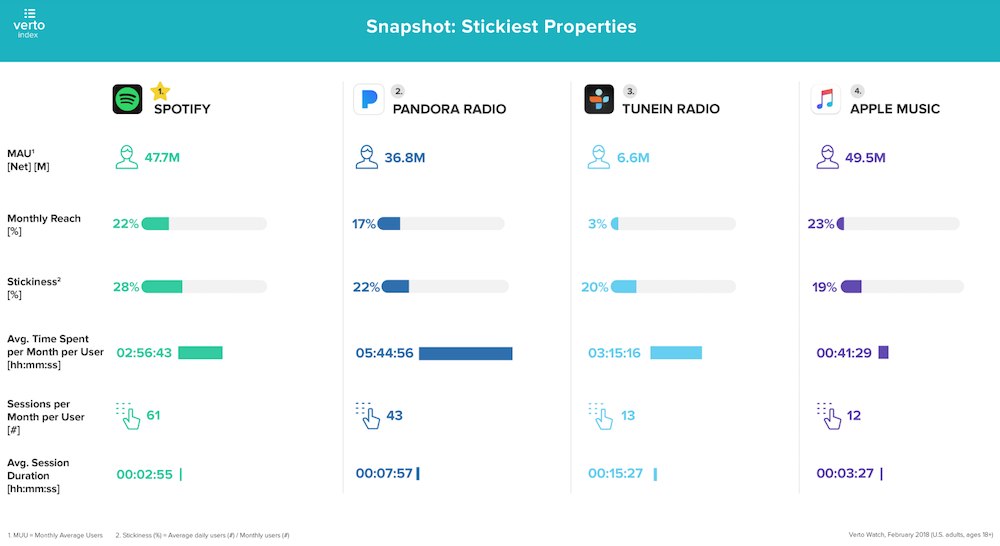

Apple Music tops Verto’s overall chart by both monthly unique users (49.5 million) and monthly reach (23%) for February 2018. Spotify’s 47.7 million and 22% stats secured it the second spot. Verto’s analytics placed Pandora as the third most popular streaming site, followed by SoundCloud and Google Play Music.

The MAU (Monthly Active User) metric in the Verto index differs considerably from Pandora’s reported 75-million monthly unique listeners. Verto methodology is not explained sufficiently in the public report to explain the difference. Using another filter, when we multiple Pandora’s 43 sessions per month/user by the total number of users (about 36-million) we get 1.5-billion sessions — that is far lower than the Average Active Sessions (AAS) statistic in the monthly Webcast Metrics Ranker from Triton Digital. (AAS measures an active session as lasting a minimum of one minute — perhaps a shorter requirement than Verto uses.)

The upshot for us is that the Verto Index is interesting mainly in comparing its internal statistics, since they are all produced the same way.

The report also reviews “stickiness,” a comparison of daily and monthly users designed to assess how loyal and engaged a music service’s users are. Spotify topped that metric with 28% stickiness. The average time spent in Spotify per month per user was almost 2 hours, 57 minutes. Pandora posted a stickiness rate of 22%, followed by TuneIn Radio at 20% and Apple Music at 19%.

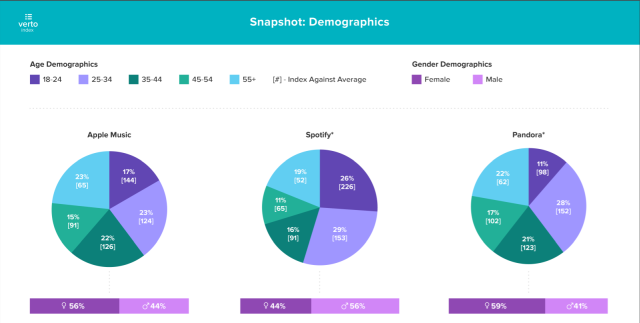

Spotify also had the largest audiences among younger generations. Verto broke down the ages of listeners for Apple Music, Spotify, and Pandora. Spotify’s shares of the 18-24 and 25-34 age groups were notably larger than the rival services, 26% and 29% respectively. On the flip side, Apple Music and Pandora had larger percentages in the other age populations. Even one bracket up in ages 35-44, Spotify had just 16% while Apple Music had 22% and Pandora had 21%.

Finally, Verto delivers an age/gender demographic snapshot, as illustrated below: